This policy brief focuses on the lack of transformation of the economy, drawing on comparisons between the Philippines and its Southeast Asian neighbors. It asks why economies like Malaysia and Thailand grew faster after 1980 while the Philippines failed to do so. Moreover, poverty reduction was much faster in these countries. The role of foreign direct investment (FDI) in development is highlighted. VIEW PDF

The manufacturing sector and inclusive growth

Data from the Family Income and Expenditure Survey (FIES) indicate that families whose household heads have a low educational attainment have a higher incidence of poverty. For example, in 2012, the poverty incidence of families whose household head completed an elementary education only was 24.5%. However, among families whose household head completed high school, the poverty incidence drops to 11.9%. The poverty incidence for those who completed college was a mere 1.4%.

The educational attainment of the workforce in the manufacturing sector is relatively lower than among workers in the service sector. The latter employs more college graduates whereas the manufacturing sector employs more high school graduates. The service sector appears to rely more on college graduates because of the surge in opportunities from the business process outsourcing (BPO) sector.

Because the manufacturing sector has a higher labor productivity, more high-paying jobs can be found here than in the other sectors. For instance, based on data in 2014, high school graduates and those with a high school education get an average wage of PhP 335.71 in the manufacturing sector compared to PhP 291.28 in the service sector. In other words, with the same educational attainment, a typical worker should find a higher paying job in the manufacturing sector. The conclusion derived from this analysis is that a more dynamic—and perhaps more labor-intensive— manufacturing sector would have provided more higher-paying jobs to the less-educated workforce, thereby making poverty reduction faster.

Regional production networks, manufacturing sector, FDIs

Arguably, regional economic integration was largely driven by regional production networks (Fujita, Kuroiwa and Kumagai, 2011). Trade and investment flows that intensified over the years were compelled mostly by the international production system that emerged. Regional production networks, defined as “the internationalization of a manufacturing process in which several countries participate in different stages of the manufacture of a specific good” (Yeats, 1998, p. 1), were taken as one of the main drivers of the economic transformation in Southeast Asia.

The primary beneficiary of the expansion of regional production networks has been the domestic manufacturing sector. With a modest start in the electronics and clothing industries, multinational production networks have gradually evolved and spread into many industries, such as sports footwear, automobiles, televisions and radio receivers, sewing machines, office equipment, power and machine tools, cameras and watches, and printing and publishing (Athukorala, 2010).

Historically, economic transformation has been driven by the manufacturing sector. Hence, the surge of FDI flows in the region, and the establishment of regional production networks which has accelerated the development of the recipient economies.

The economic transformation can be observed from the increase in the share of value-added from the manufacturing sector in relation to total GDP for Indonesia, Malaysia and Thailand between 1990 and 2014. Between 1993 and 2013, the Philippines experienced the largest increase in terms of the share of manufactured exports to total exports. Nevertheless, the manufacturing sector in the Philippines has stagnated, based on its share to total GDP. There has been a dichotomy between the export sector and domestic manufacturing sector. [back to top]

Stagnant manufacturing sector

Although the Philippines may have been successful in dramatically changing its trade structure and latching on to regional production networks (being one of the region’s major supplier of technology-intensive semiconductors), the country’s manufacturing sector still stagnated and failed to generate needed growth and employment for the economy.

The Philippines has one of the lowest investment rates in the region. FDI inflows into the Philippines pale in comparison with what its neighbors attract, lagging behind even Viet Nam which lived with a trade embargo for a long while and has a lower per capita income.

Can the Philippines attract more FDIs?

The relatively low FDI inflows have limited the scale of Philippine participation in regional production networks and this is reflected in the relatively low level of exports. At this juncture, a key policy question is whether policymakers in the Philippines should focus on attracting more FDIs. An important assumption is that the manufacturing sector is still the most important driver of sustainable economic development.

The increasing trend in wages and the shift in China’s economic strategy will have profound effects on the pattern of regional production networks. Higher wages have already prompted many low-cost, labor-intensive industries, such as garments, toy and shoe manufacturing, to transfer some production to cheaper locations. China’s role in processing trade will therefore diminish. This will provide opportunities for other economies in East Asia particularly the CLMV (Cambodia, Laos, Myanmar, Vietnam) countries. Intra-regional trade will then be geared towards China as a destination of finished goods.

The realignment of regional production networks provides challenges and opportunities for the Philippines. The latter’s political and diplomatic tensions with China will not influence the decision where to relocate components of the global value chain. However, the challenge lies in how the Philippines fares in terms of the factors that do matter.

Bhatia (2012) identifies four crucial factors that affect value-chain decisions: (1) the potential of the local market, especially when the country represents a potential large market; (2) availability of suitable human resources - for a technology-intensive company, productivity is more important than labor cost, and for design-intensive activities, access to the best possible knowledge is critical; (3) availability of physical infrastructure; and (4) strong legal and policy environments that embed the rule of law.

Unfortunately, the Philippines does not fare too well in these factors when compared to its neighbors in Southeast Asia. The challenge is to implement at the soonest possible time structural reforms to address what can be described as “supply side constraints.” [back to top]

The Way Forward

Granted that it would be difficult for the Philippines to attract more FDI in the short-to-medium term, policymakers should explore more feasible alternatives to expand the manufacturing sector. There is a need for economic diversification in all three major sectors—manufacturing, agriculture, services—of the economy. To achieve this, the more important considerations are a strategic and coherent industrial policy, and maintaining a realistic exchange rate.

Granted that it would be difficult for the Philippines to attract more FDI in the short-to-medium term, policymakers should explore more feasible alternatives to expand the manufacturing sector. There is a need for economic diversification in all three major sectors—manufacturing, agriculture, services—of the economy. To achieve this, the more important considerations are a strategic and coherent industrial policy, and maintaining a realistic exchange rate.

In addition to the low investment rate, other reasons for the lack of economic transformation relate to problems of market failure. Industrial policies are those that address market failure while promoting diversification of production activities into new areas, facilitating restructuring of existing activities, and fostering coordination between public and private entities to make all of this happen. These policies need not be restricted to the industry sector. They also apply to the development of non-traditional activities in agriculture.

In the context of a long-term development strategy, an industrial policy would therefore have two major objectives. One is to generate more employment by involving SMEs in global and domestic production networks and supply chains. This can be facilitated by improving their technological capability, which has a direct impact on labor productivity. The latter, together with improving the technological capability of larger firms, would be the second objective of industrial policy.

Another important supply-side constraint is poor physical infrastructure. Almost all ASEAN member states outrank the Philippines in terms of the quality of infrastructure. An ADB study concludes that “low levels of investment in and poor conditions of infrastructure in the Philippines have increased the cost of doing business in the country and has had significant adverse impact on the perceived competitiveness and attractiveness of the Philippines as an investment destination” (ADB, 2007, p.25).

Complementary policies to the ASEAN Economic Community (AEC) are important because trade facilitation may only be of secondary importance in expanding economic activity in the region. For example, Cheewatrakoolpong, Sabhasri and Bunditwattanawong (2013) argue that investment promotion has been more important than free trade agreements in building regional production networks. Hence, the AEC has to go beyond the free flow of factors of production. Policies and reforms to attract investment have to be implemented, and none would be more important for the Philippines than improved physical infrastructure.

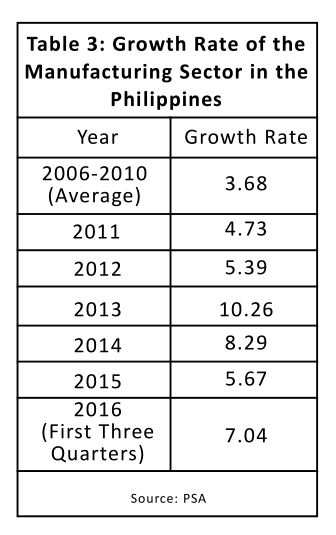

Meanwhile, growth of the manufacturing sector averaged 6.9% in the period 2011–2015 after averaging only 3.7% in the previous five-year interval. In the first three quarters of 2016, growth was a robust 7%. One possible reason is the attention that the Department of Trade and Industry (DTI) gave this sector beginning in 2011 by supporting roadmaps for the different sub-sectors. The roadmaps yielded policy recommendations to address bottlenecks in the manufacturing sector. [back to top]

About The Author

Dr. Josef Yap is a Professorial Lecturer at the School of Economics, University of the Philippines Diliman. He is former President of the Philippine Institute for Development Studies.

About The Policy Brief

This policy brief of Dr. Josef Yap is an abridged version of his paper presented at the policy forum, “Making Investments Work: Paradigms, Patterns, Prospects,” held on 24 November 2016 at Balay Kalinaw, University of the Philippines Diliman. It was organized by the Bugkos—”Asia in Transition” institutional research program of the UP Asian Center. The policy paper was funded by the UP System Emerging Inter-Disciplinary Research Program (OVPAA-EIDR-06-27). [back to top]

Other Policy Briefs

- Foreign Investment and Philippine Development: A Comparative Approach | Online • PDF

- Rechanneling Investments from Private to Business to Nation-building | Online • PDF

- Download all three policy briefs as one PDF

REFERENCES

Asian Development Bank. (2007). Philippines: Critical development constraints. Manila: Asian Development Bank Economics and Research Department. [back]

Athukorala, P. (2010). Production networks and trade patterns in East Asia: Regionalization or globalization? Working Paper Series on Regional Economic Integration No. 56. Manila: Asian Development Bank. [back]

Bhatia, K. (2012). “Case-study 1: General Electric Corporation – Advanced Manufacturing in Perspective.” In the Shifting Geography of Global Value Chains: Implications for Developing Countries and Trade Policy (pp. 24–26). World Economic Forum. [back]

Cheewatrakoolpong, K., Sabhasri, C., & Bunditwattanawong, N. (2013.) Impact of the ASEAN Economic Community on ASEAN Production Networks. Working Paper Series No. 409. Tokyo: Asian Development Bank Institute. [back]

Fujita, M., Kuroiwa, I. & Kumagai, S. (2011). The economics of East Asian integration: A comprehensive introduction to regional issues. Cheltenham, UK and Tokyo: Edward Elgar Publishing Ltd and Institute of Developing Economies, Japan External Trade Organization. [back]

Yeats, A. (1998). Just how big is global production sharing? Policy Research Working Paper No. 1871. Manila: Asian Development Bank. [back] [back to top]